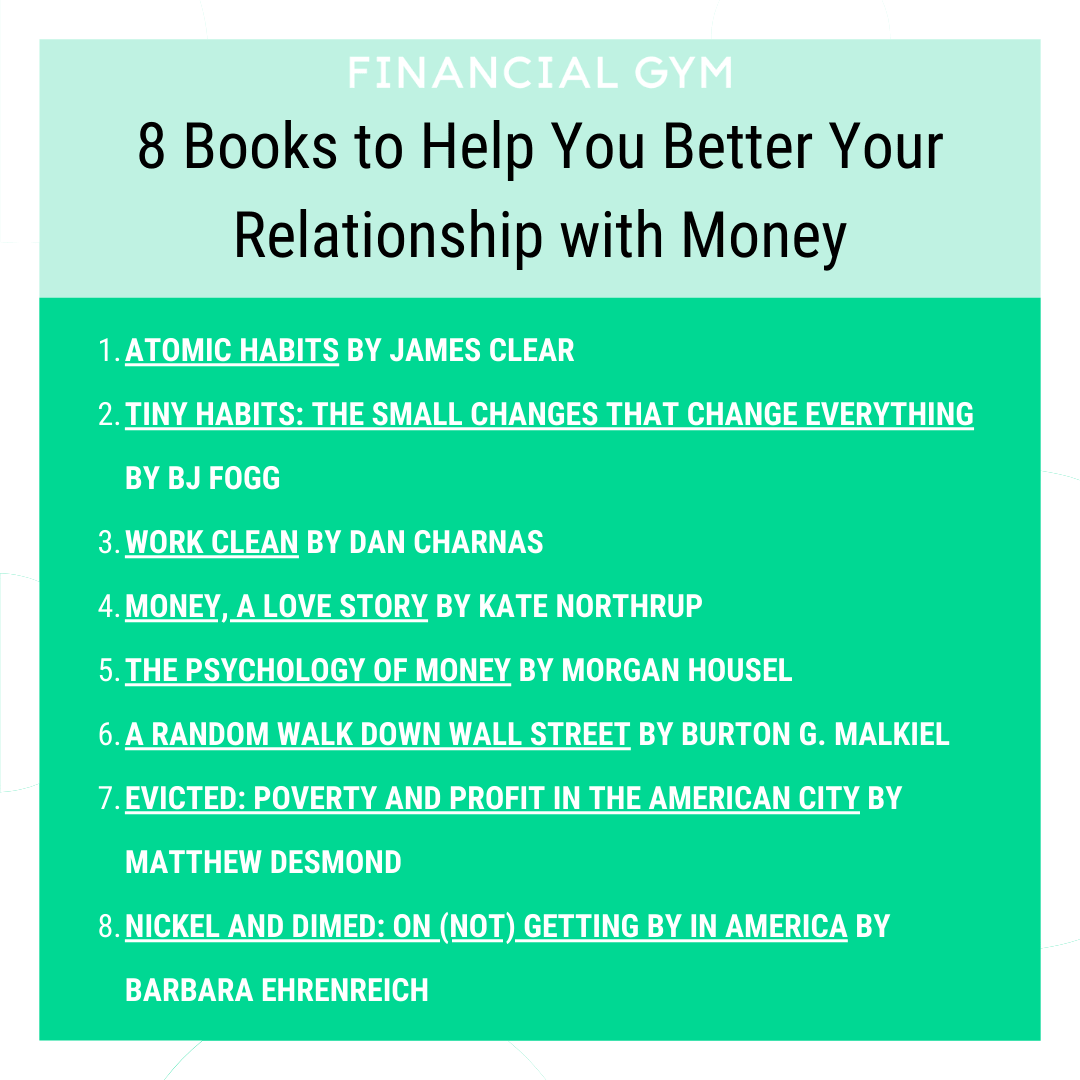

8 Books to Help You Better Your Relationship with Money

It’s the beginning of a new year, so it’s time for those new year's resolutions to kick in right? Whether it’s for your health, to read more, to travel more (hopefully we can do this!), and many others I hope that one news year's resolution is to make sure your finances are in order.

My mantra to my clients starting from January 1, 2020 was #NewDecadeNewFinances. A way to think about finances in a fun, fresh new way. So far… well it’s been a decade hasn’t it? And we’re only on year number 2! But even with everything going on in the world, even if you may not be able to start on all things you want to do financially, you can be equipped with the tools to succeed when you are ready.

Below are some books you can read to help you start making changes now or be ready for when you are able to make some changes to your finances:

Atomic Habits - this book gives you strategies and tools that you can implement to help with forming (and keeping!) good habits, which is a great skill to have when managing your money.

Tiny Habits: The Small Changes That Change Everything - this is another book that can help you with good habit forming strategies.

Work Clean - this book could be read, and used, in conjunction with either of the books above as it focuses on how to organize yourself most efficiently. You could read one of the above books on how best to form new habits (and keep them) and then use this book to organize all the new habits you’ve formed.

Once you have mastered the skills of good habits, it’s now time to take managing your finances to the next level. But first, it is usually a good idea to understand your relationship with money in general. Money, A Love Story is a book that helps you to define your relationship with money.

The Psychology of Money - this book is not only a great read to help you think about the bigger picture in terms of your finances, but it also provides insight on how much emotions really play a part in financial decisions.

A Random Walk Down Wall Street - this book is all about how to survive investing.

While most individuals would like to earn more so that they can live a comfortable life, free from financial worry, I do believe that at the same time of learning how to earn more and make your money grow for you it is important to learn that unfortunately not everyone will reach the same goals.

Evicted: Poverty and Profit in the American City - this book aims to help explain poverty, economic exploitation, and provide “fresh ideas for solving one of 21st-century America's most devastating problems.”

Nickel and Dimed: On (Not) Getting by in America - this book is the author’s recount of working minimum wage jobs across America and the insights she learned from it.

Now that you have created good habits, learned about your relationship with money, and taken it to the next level of growing your money you should be all set to conquer your financial dreams!

Hopefully you have loved reading about money and finances, so I’ll leave you with a few more books that you can read, if interested:

Freakonomics: A Rogue Economist Explores the Hidden Side of Everything

Heartland: A Memoir of Working Hard and Being Broke in the Richest Country on Earth

Also, you don’t necessarily have to go out and buy all these books; check your local library to see if they have a copy (or if they don’t, maybe they can get one) so that way you learn about finances, but for free!

If you’re interested in learning more about this topic, check out our course: Creating a Healthy Money Mindset.

Ready to take your finances to the next level?

To get started schedule a free 20 minute consultation call to speak to a member of our team. We will ask you a few basic questions to get to know you more, walk you through our financial training program steps, and of course answer any questions you may have. No pressure to join!