The Financially Free Blog

4 Step Salary Negotiation for the Pay You Deserve

Negotiation is a nuanced term. To negotiate means to obtain or bring about by discussion. The art of negotiation isn't taught and it is not innate. It is a process of calculation, evaluation, confidence, and effective communication. It is more important than ever that you learn and hone the art of negotiating so you can advocate for yourself, own your power and understand your value.

How to Plan a Budget Road Trip

Road trips are the epitome of freedom and adventure. With the open road ahead and countless possibilities, it's no wonder so many people dream of hitting the highway. But how do you plan a road trip that won't break the bank? Here’s your guide to making it happen.

How to Build an Emergency Fund (And Why You Need One)

When emergencies happen, your whole life can be put on hold. You have a death in the family, your car gets totaled or you find out quite unexpectedly you’re getting let go. These are considered emergencies because they must be dealt with right now and the severity can consume all of your attention. Not only that, it can also cost you a lot of money too. That’s why you need an emergency fund.

What to Do With Childhood Savings Bonds

Savings bonds—once the “responsible” go-to gift for baby showers, birthdays, and graduations—have fallen out of fashion. Still, as a millennial or Gen Xer, it’s entirely possible to stumble across a long-forgotten pile of paper savings bonds and wonder what to do with them.

5 Travel Hacks to Save Money on Your Next Trip

Although summer is coming to a close, the next big travel season is kicking back up again thanks to the holidays. It might feel too early to think about holiday travel, but let’s be honest, those Halloween decorations are already creeping onto store shelves.

According to Skyscanner, August is the best month to book flights domestically while September is ideal when booking international travel. If you’re looking for ways to save money on your next vacation, there are other travel hacks to keep in mind aside from good timing.

How to Get Out of a Spending Shame Spiral

Have you ever felt bad about your spending and then spent even more money to make yourself feel better? If so, you, my friend, have experienced a spending shame spiral.

While it may seem counterintuitive, spending shame spirals are common because of the way that shame affects our behavior. Shame is an extremely powerful (and unhelpful) emotion. Rather than motivating us to make decisions to reduce our shame, it leads us to take actions that replicate it again and again. Fortunately, there is a way out of the shame spiral.

Message from the CEO - Setbacks vs. Comebacks

I don’t know about you, but I love the Olympic season, both winter and spring. To me, there is nothing like the drama, joy and exhilaration the Olympic games makes you feel. Every night I watch the coverage on NBC in awe of the athleticism, nervous for the athletes and parents, filled with pride for Team USA and most of all, I’m inspired by the stories of athletes who are there for a comeback journey and shot at redemption.

What to Know About Sales Tax Holidays

We’ve all heard the saying, “Nothing is certain except death and taxes,” but millions of people can avoid taxes for at least a few days each year through a sales tax holiday. Read about what a sales tax holiday is and how to get the most out of it.

6 Tips On How to Reposition Yourself After a Job Loss

Maybe you saw it coming, maybe it blindsided you, but it happened: you lost your job. Whether it’s from a change in the industry, a layoff due to company finances, or even something specific to you and your role, the end result is the same: you’re looking for work.

Best Credit Card Perks for the Summer

Summer is a time for fun, but between travel, activities, and cookouts, it can be hard on your bank account. Luckily, you probably already have something in your wallet that can help reduce costs and make your summer more enjoyable: a credit card with perks. Here are the best credit card perks to take advantage of this summer.

What to Know About Paused Payments For SAVE Plan Borrowers

Federal student loan borrowers have been experiencing whiplash as legal challenges to the SAVE plan move throughout the courts. In late June, district court judges in Missouri and Kansas paused parts of the SAVE plan, but an appeals court ruled that parts of it could continue. On July 18th, another appeals court ruling of the Missouri case blocked implementation of the SAVE plan entirely until that case is resolved.

5 Ways to Keep Your Summer Spending in Check

Happy hours…weekend trips…BBQs….weddings….Do you find yourself spending extra during the summer months? Here’s how to keep your summer spending in check.

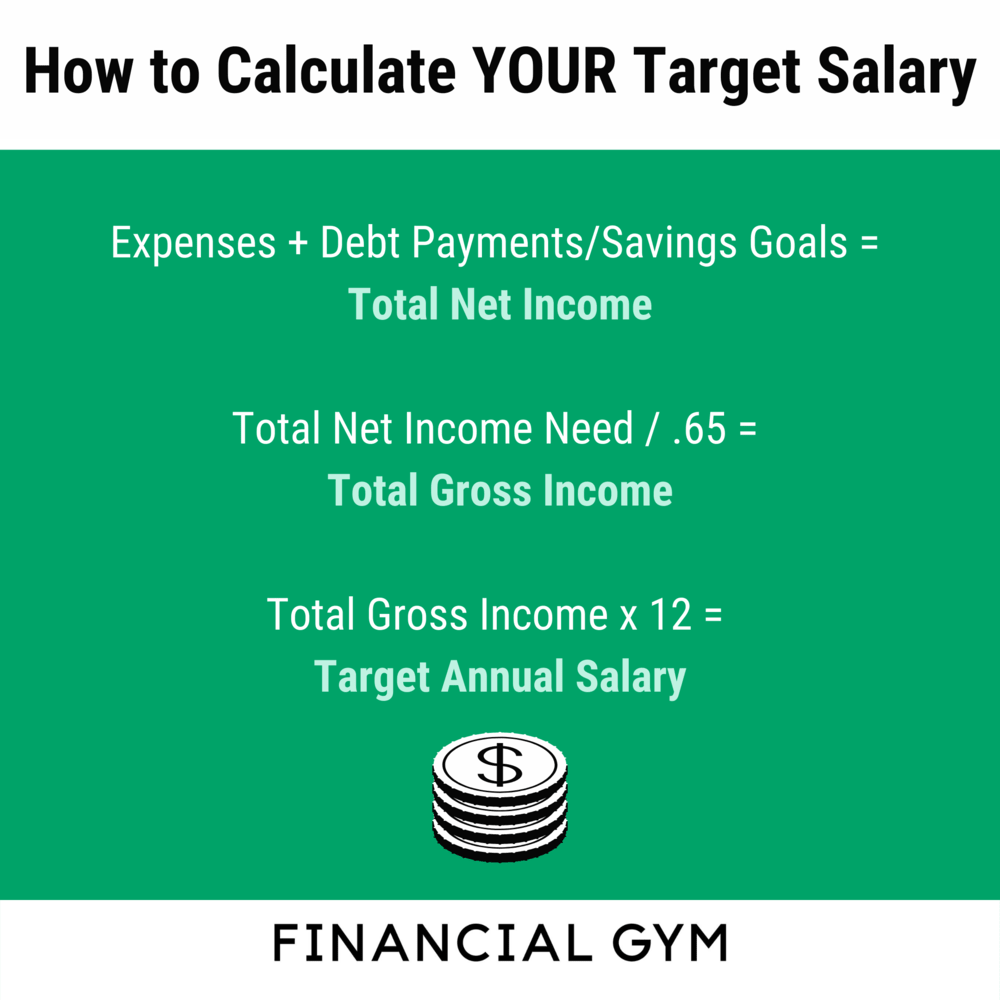

4 Ways to Figure Out What You Need to Earn

Much of the time we find that our clients who are struggling to make all of their expenses and save money on a monthly basis simply need to make more money. This may sound like a no-brainer, but it is important to recognize your worth! If you think this situation is applicable to you, check out our salary negotiation tips during a pandemic.

5 Creative Savings Tips When Attending a Summer Wedding

Does it feel like your calendar in the next few months is inundated with wedding festivities? Don’t worry — you’re not alone: about 30% of couples tie the knot during the summer.

How to Live Rent-Free

These days, affording day-to-day expenses—including a place to live—is putting a strain on renters’ budgets. The numbers back that up: between 2019 and 2023, rent prices increased by over 30% across the country. However, if you are willing to get creative, there are options for living rent-free!

Mid-Year Check-In: Are You on Track With These 5 Goals?

The summer months are a good reminder of how time flies when you’re working toward your personal goals. With the end of 2024 creeping up on the horizon, now’s a perfect time to do a financial wellness check and keep your finances in tip-top shape.

Here are a few areas to check-in with to make sure you’re on track for a financially fit year.

3 Essential Concepts To Reach Financial Independence

Financial independence—having enough financial resources to cover your expenses without working—is appealing to just about everyone. Even if you love your job and plan to work all your life, you might not always have that luxury as layoffs or health issues could affect your plans. For that reason, we at the Financial Gym believe that financial independence should be on everyone’s goal list, and no matter where you are starting financially, you can actively work toward financial independence. Here are three financial independence concepts that will help you get there.

What You Should Know About Challenges to the SAVE Plan

Do you ever feel like you just can’t catch a break? That’s the sentiment among many student loan borrowers ever since the Supreme Court struck down President Biden’s initial student loan forgiveness plan last year. Just last week, borrowers got more bad news from the courts: two provisions of the SAVE plan have been (at least temporarily) halted by legal challenges.

How to Choose a 529 Plan

Whether you’ve just had your first child or it’s been a few years, at some point, saving for your child’s college education has likely crossed your mind. Choosing where to set up an account can be a major barrier to getting started, and for that reason, many people default to their own state’s 529 plan, but that might not always be the best option. Follow these steps to pick the best 529 plan for your family.

The Cost of Keeping Cool: Managing Air Conditioning Expenses in Summer

As the summer heat ramps up, so does the temptation to crank up the air conditioning. While it's a relief to have a cool oasis indoors, it can also lead to a spike in energy bills. Managing air conditioning expenses effectively can help keep your home comfortable without breaking the bank. In this blog post, we'll explore strategies for controlling and reducing air conditioning costs during the summer months.