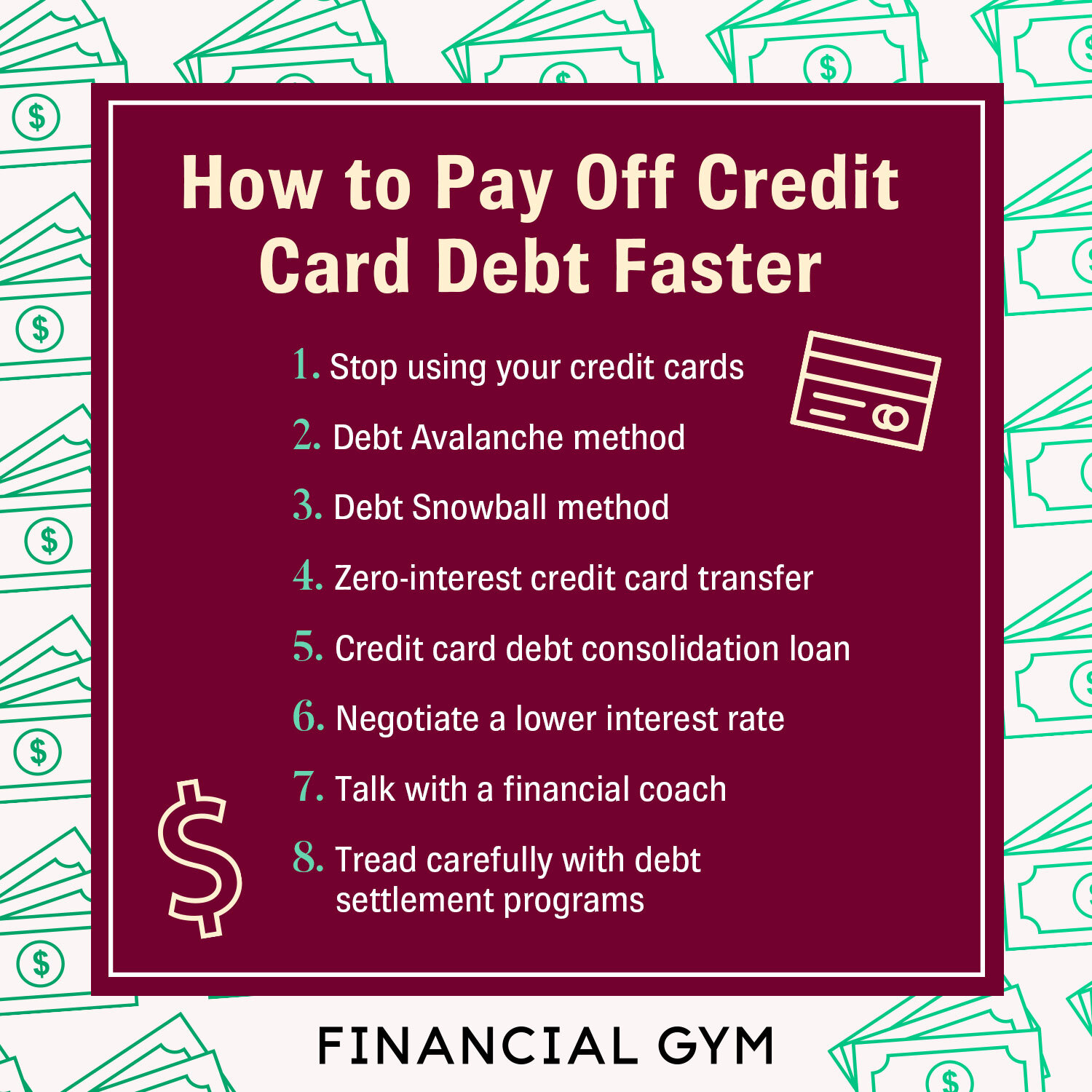

How to Pay Off Credit Card Debt Faster

Revolving lines of credit, like credit cards, are a helpful tool when used responsibly. However, it can also lead to a slippery slope when it comes to racking-up credit card debt. Although getting out of credit card debt isn’t as easy as snapping your fingers and wishing it away, there are a few strategies to repay your debt faster.

Related: 5 Tips to Break the Paycheck-to-Paycheck Cycle

Stop using your credit cards

It seems like an obvious first step, but it’s a critical one. Putting more purchases on your credit card will only cause your total debt to balloon. If you’re already letting your statement balances roll over to the next month, it’s a sign that you’re spending more money than you can afford to repay already.

Keep your credit cards out of reach, whether that means putting them in a hard-to-access drawer or cutting them up.

Debt Avalanche method

We’ve mentioned the debt avalanche repayment strategy a few times at The Gym. It works by prioritizing your highest credit card interest rate, first. You’ll put as many financial resources toward paying off that balance while making minimum payments on all other debt. When the first account is repaid, direct the money you used to pay toward that account to your next-highest APR card.

Since you’re paying off the highest APR cards first, you’ll save money in the long-run by reducing steep interest charges.

Debt Snowball method

This is another debt repayment approach that relies on “immediate rewards” to help you get out of credit card debt faster. Under this strategy, you’ll make higher payments on credit card accounts with the lowest balance, regardless of its APR.

The theory is that you’ll repay the balance on this account sooner which keeps your momentum going to repay the next-highest balance. Although it won’t save you as much money on interest compared to the debt avalanche, it motivates you to stick to your debt-free goal.

Zero-interest credit card transfer

Signing-up for a 0% APR credit card balance transfer can be an effective debt repayment option. If you have strong credit, you may have seen offers to transfer the balance on your existing cards onto a new credit card at no interest.

There’s a caveat, though. The 0% interest rate is only a promotional rate that expires anywhere from three months after opening the new card to as long as 24 months or more, depending on the offer. Also, these offers often charge a balance transfer fee of about 3% of the amount you’re transferring or a flat fee (whichever is higher). Always calculate the potential savings after adding this fee, to decide if it’s really worth it.

Credit card debt consolidation loan

A debt consolidation loan is simply a personal loan that you can use as a way to repay revolving debt balances. After you’ve secured the loan funds, you’ll use it to repay your credit card debt in one fell swoop. After you’ve repaid your credit debt, you’ll make monthly payments toward the consolidation loan.

The benefit of this option is that, depending on your credit score, you may be approved for a lower interest rate. You can find debt consolidation loans through your bank, credit union, or online lender. If you’re seriously considering this option, compare multiple offers to ensure you move forward with the lowest interest rate offer and terms.

Negotiate a lower interest rate

Contacting your card issuer to request a lower interest rate is another option when figuring out how to pay off credit card debt faster. Although this tactic doesn’t reduce the principal that’s due on your account, it lessens the impact of high APR charges to your account.

To get out of credit card debt, you may need to use multiple strategies and this is one of them. If you have strong credit and your account is in good standing (i.e. you’ve never been late or missed a payment), a two-minute phone call to your credit card company may be all it takes to lessen the cost of your debt.

Talk with a financial coach

Want to learn more about how to pay off credit card debt faster, based on your unique circumstances? A financial coach can help you with a customized budget and credit card repayment plan. Our trainers are certified through The Gym’s proprietary curriculum and can support you with in-person of virtual financial training sessions.

Reach out today for a complimentary 20-minute consultation!

Tread carefully with debt settlement programs

Debt settlement programs are for-profit services offered by an agency that works directly with your creditors to reduce your debt obligation and settle your accounts, permanently. For example, if you owe $9,000, it might try to negotiate a $6,000 lump sum with your creditors.

Getting out of debt through this method is tricky. Some cons to this debt payoff option include:

Debt settlement charges high fees

The process can take a long time from start to finish

You may owe more money after settlement service fees, late fees, and accrued interest

Withholding payments negatively affects your credit score

Debt collectors can still actively collect on the debt and may take you to court

You may owe taxes on the amount of debt that’s forgiven

There are many debt settlement scams to watch out for

These companies encourage you to stop making payments on your credit card debt. Instead, it asks you to funnel those payments into an account that the company has access to. If the company successfully settles, it uses the funds in the account to pay the credit issuer.

The list above is just a few ways to get out of credit card debt. Not every strategy is ideal for your specific situation and credit card debt repayment can be complex to navigate. If you want one-on-one support, a financial coach can help you sort through the best debt strategy for you.