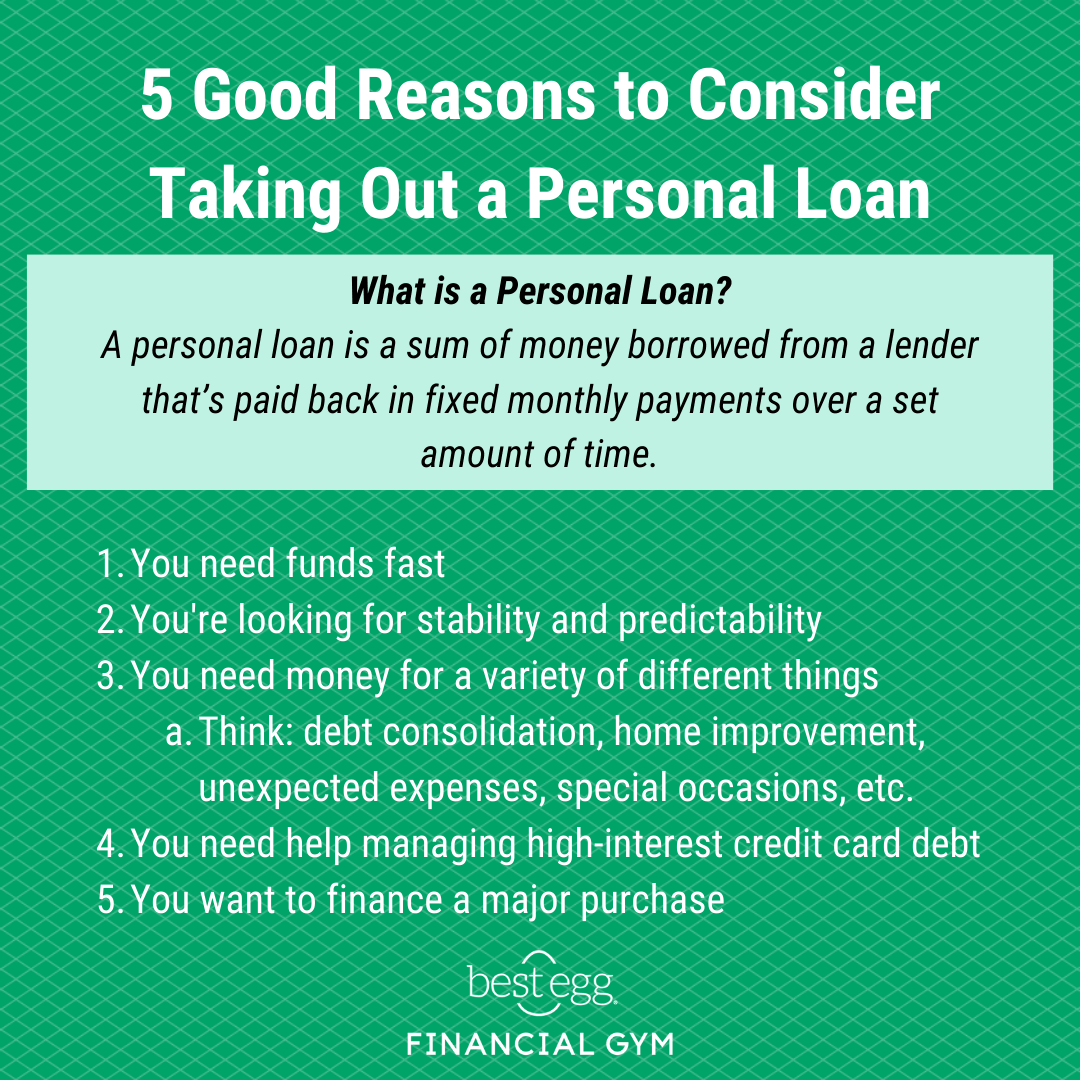

5 Good Reasons to Consider Taking Out a Personal Loan

When it comes to the financial products that empower you to take care of the things that matter most in life, there’s no shortage of available options. Each product has its own strengths and purpose, and your financial situation and personal goals play a large role in deciding what the best choice is for you. In this article, we’re going to cover a few good reasons you might consider taking out a personal loan.

Before we get into the reasons you might consider taking out a personal loan, it’d be helpful if we briefly reviewed what they are.

What is a Personal Loan?

A personal loan is a sum of money borrowed from a lender that’s paid back in fixed monthly payments over a set amount of time. While loan amounts vary lender to lender, they frequently range anywhere from $2,000 all the way up to $100,000, making them a quality option for borrowers with a wide variety of needs. The loan amount and interest rate a borrower qualifies for is based on a variety of factors, including their income, credit score, and financial history.

Personal loans are a type of installment loan, just like mortgage, auto, and student loans, and they work in a similar way. If you’re approved, you receive a lump sum of cash that you repay in fixed monthly payments until the loan is paid back in full.

Alright, that’s enough on what personal loans are all about – now let’s talk a bit about why you might consider applying for one.

When You Need a Personal Loan

You Need Funds Fast

If we know one thing to be true, it’s that life is full of many surprises – and some are less welcome than others. When you’re hit with an unexpected expense, whether it’s a medical emergency, unanticipated auto repair, or the contractor’s bill to fix your leaky roof, it’s comforting to know that you could have the money you need to handle the situation in as little as 24 hours.

The loan doesn’t only have to be used for unexpected expenses or emergencies either – maybe there’s a home improvement project you’ve been dying to get started on but you don’t have the money you need to get it underway (like giving that home office you’ve been spending so much time in a well-deserved upgrade.) With a personal loan, there’s no need to wait to make progress towards your goals. The applications are usually 100% online, only take a few minutes to complete, and if you’re approved, you could have the funds you’re looking for by the next day.

You’re Looking for Stability and Predictability

Personal loans generally come with fixed rates and fixed repayment terms, which provide two great benefits: your monthly payments stay the same over the course of your loan, and you’ll know the exact date your loan will be paid in full. Financial products with variable interest rates can make budgeting a headache because your payment could change month to month. With a fixed-rate personal loan, you’ll always know what you owe and can plan accordingly.

And don’t worry - just because you gain stability and predictability by going with a personal loan doesn’t mean you lose flexibility. While applying, you have the freedom to tweak your requested loan amount and repayment term length, which makes getting a monthly payment that works with your budget a breeze.

Looking for more flexibility? You’ve got it. Some lenders offer flexible payment programs, which let you skip a payment or receive a lower monthly payment if you end up hitting a rough patch. Compared to other financial products, personal loans provide a great mix of predictability and stability while still giving you the freedom to customize to your unique needs.

You Have a Few Things to Cross Off Your To-Do List

Personal loans are extremely versatile, meaning they can be used for just about anything. Debt consolidation, home improvement, unexpected expenses, special occasions… you name it. If you need funds to get a few things done, a personal loan could be a great solution for you.

Let’s say you want to pay off some high-interest credit card debt, repair a few things around the house, get a new set of tires for your ride, and buy a gift for a close friend’s upcoming wedding. Covering all of these costs with one personal loan is simple – just determine how much you’ll need to get things done and request the exact amount. If you’re approved, you’ll be equipped to handle the expenses with the added benefit of having a structured payoff plan in place.

You Need Help Managing High-Interest Credit Card Debt

Personal loans typically have lower interest rates than credit cards, which is why they’re commonly used to consolidate or refinance high-interest credit card debt. If your credit card debt has grown unmanageable, you could refinance it at a lower rate with a personal loan, helping you pay down the debt more quickly and potentially saving you money on interest.

And, if you have a number of credit card bills coming in at the end of the month, there’s no doubt that keeping track of due dates can be stressful. Instead of paying multiple bills each month, you could consolidate them all into one simple monthly payment with a personal loan.

You Want to Finance a Major Purchase

So, you’ve got a major purchase on the horizon and are trying to decide how you want to finance it. While swiping your credit card may be the more convenient option, they’re typically better suited for short-term expenses and smaller purchases you can repay within a year. Why? Well, the longer you take to pay the balance in full, the more interest you’ll be charged – and it can grow out of control, fast.

In general, personal loans are better suited for long-term, larger expenses that will take you more than a year to repay. Longer repayment terms give you more time to pay back your balance, and lower rates mean you won’t accumulate nearly as much interest on your purchase. For these reasons, financing a major purchase with a personal loan is usually the option that’ll save you the most money in the long run.

Want to see what a personal loan could do for you?

If you’re interested in seeing what you could qualify for but aren’t quite ready to take the leap, you’re in luck. Many online lenders allow people to check their rates without impacting their credit score, so there’s no harm in seeing what you could qualify for.

If you’d like to check your rates with us, you can visit bestegg.com to get started. It’s simple, won’t take more than a few minutes, and we think we’re pretty great at what we do (though we may be a bit biased.)

Thanks for reading!